Why Most Adults Struggle With Money (It Starts in Childhood)

If your child is under 18, this is something you shouldn’t ignore.

In the next 5 minutes, you’ll see the 3 silent money problems most teenagers develop — and why they stay for decades.

If your child is under 18, this is something you shouldn’t ignore.

In the next 5 minutes, you’ll see the 3 silent money problems most teenagers develop — and why they stay for decades.

100% REFUND POLICY

Money Habits Are Formed Early. Mistakes Stay for Life.

Be Honest — Do You See This Already?

Money Problems Start Small — Then Grow

When children don’t learn money discipline early, they carry confusion, impulsive decisions, and poor habits into adult life. Awareness is the first step — action is the next.

This ₹99 Masterclass Gives Parents Clarity on Teaching Money Right

You attend the session. You learn the structure. You guide your child with confidence.

- You’ll learn how to create money awareness in your child from day one

- You’ll learn a simple weekly money structure YOU can introduce at home (15 minutes, practical)

- You’ll know how to teach ‘needs vs wants’ using real-life examples (not theory, not scolding)

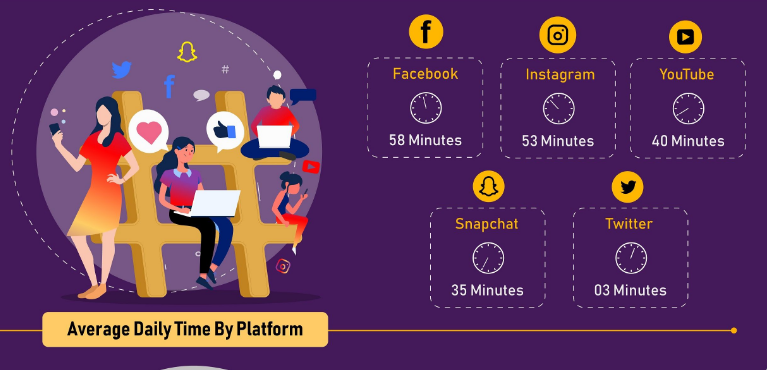

- You’ll understand how digital money is changing teen behaviour

- You’ll understand what to correct now vs what can wait (so you don’t overreact or ignore real issues)

- You’ll get a clear structure to introduce money habits without complexity

Imagine Your Child Growing Up Financially Confident

What You’ll Get for ₹99

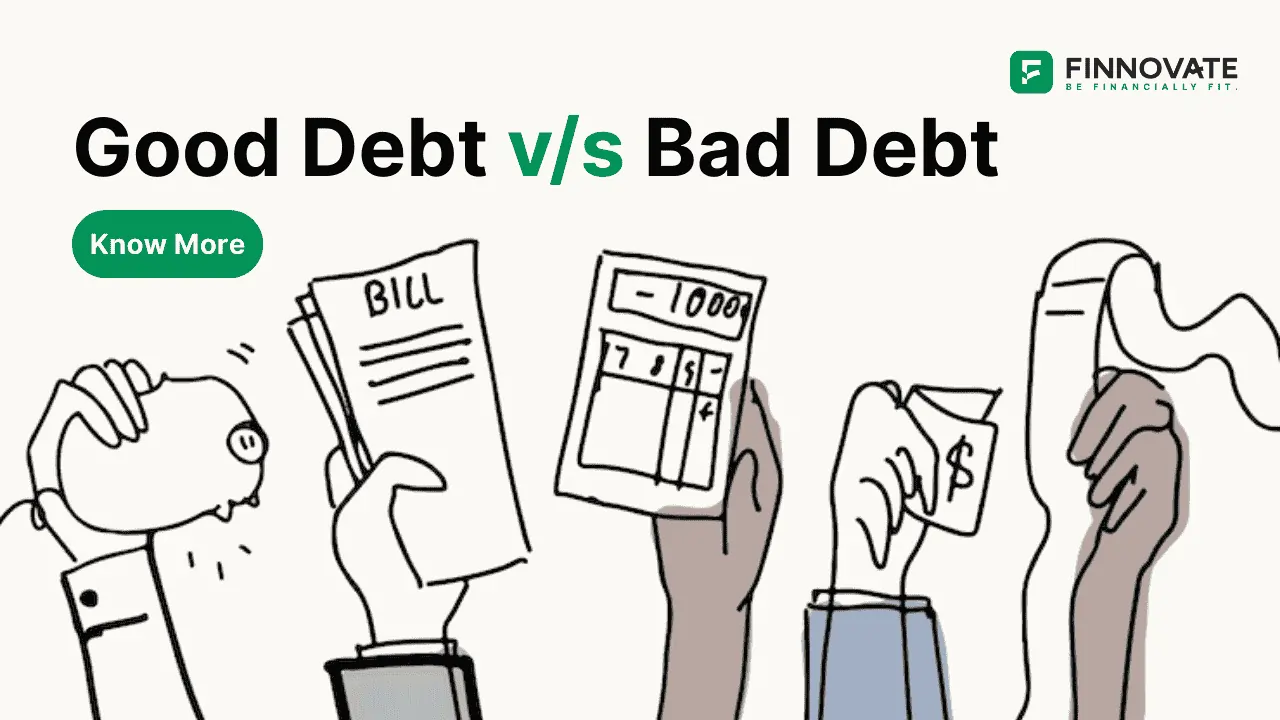

- Bonus 1

The Anti-Debt Checklist

Worth ₹ 2,999/-

- Bonus 2

Social Media Spending Guide

Worth ₹ 2,999/-

- Bonus 3

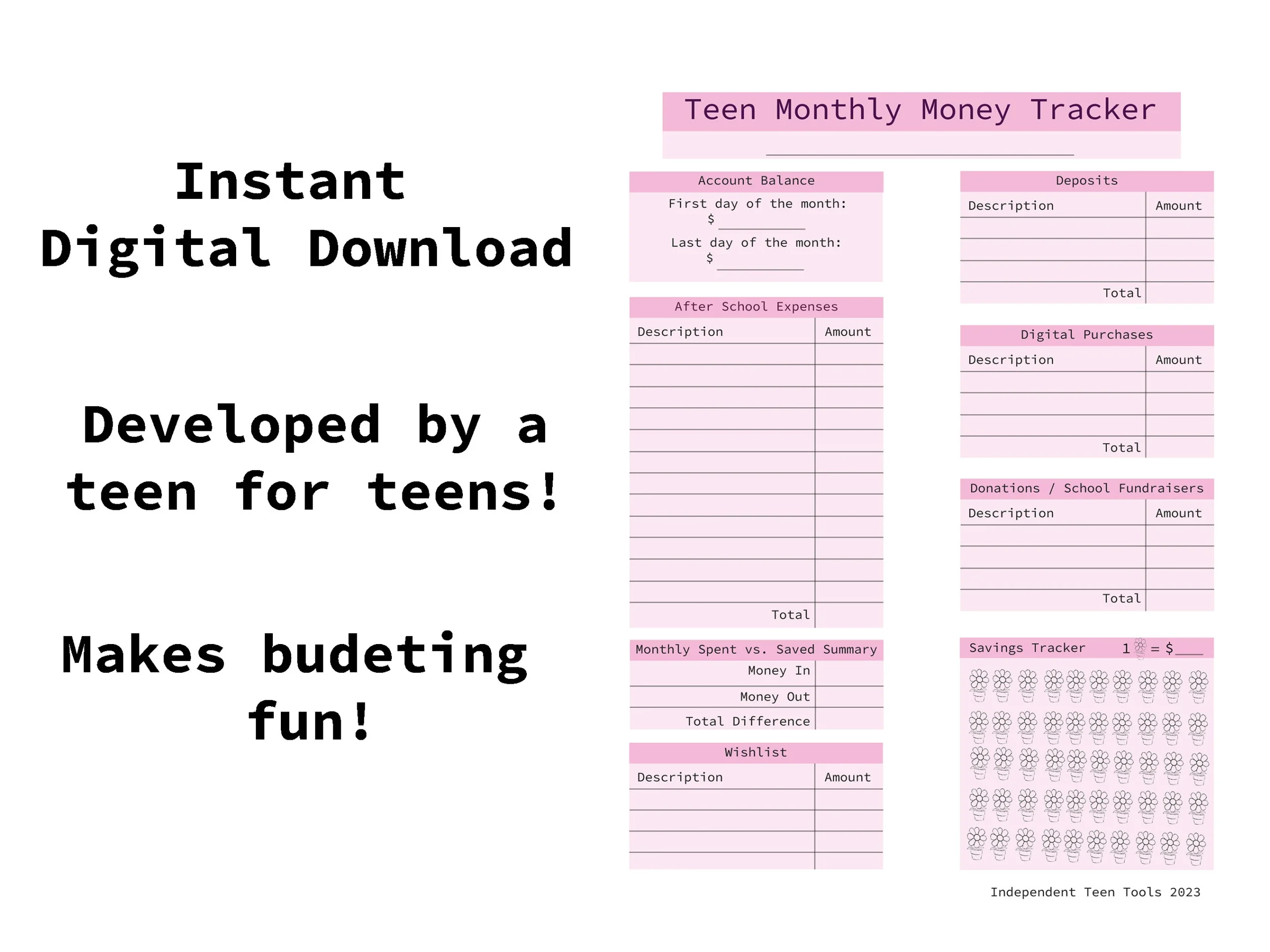

The Teen Expense Tracker

Worth ₹ 1,997/-

- Bonus 4

Parent-Child Money Script

Worth ₹ 3,997/-

- Bonus 5

Grofience Community

Worth ₹ 3,599/-

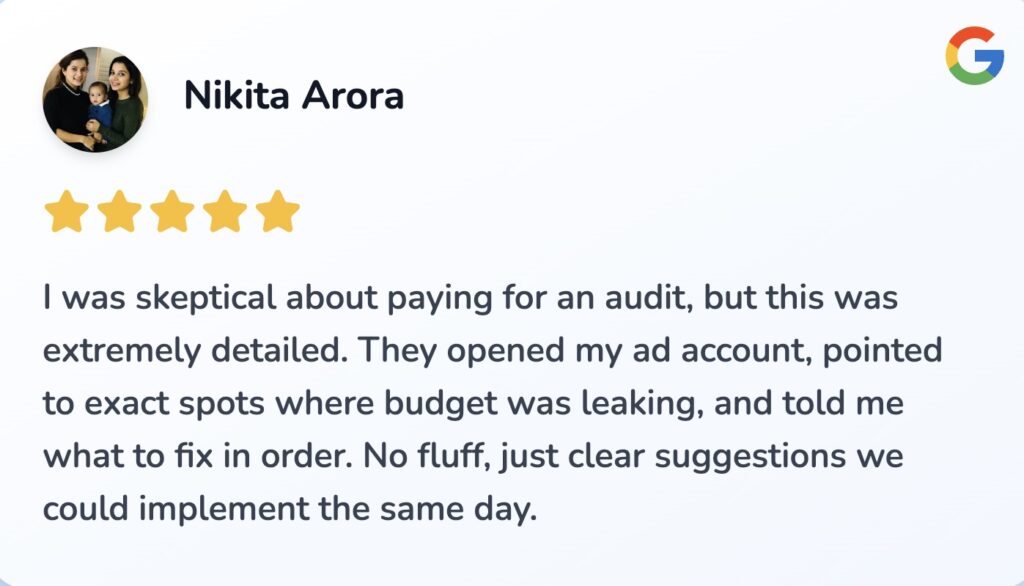

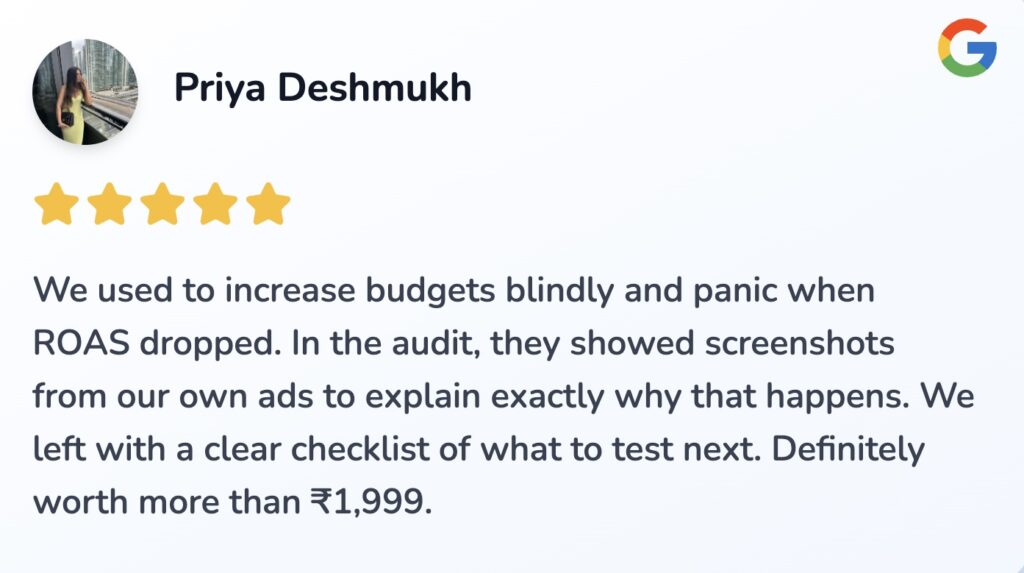

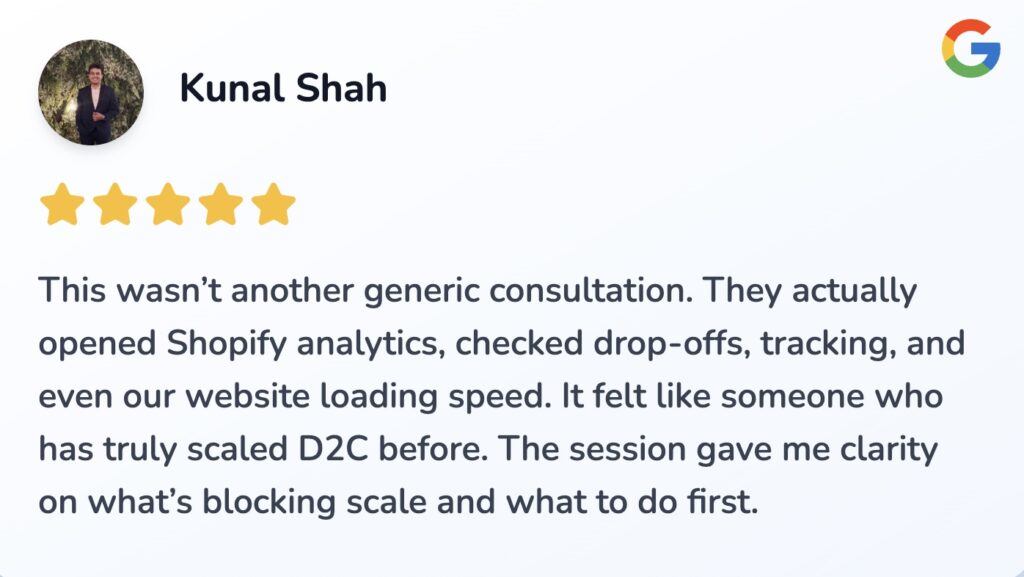

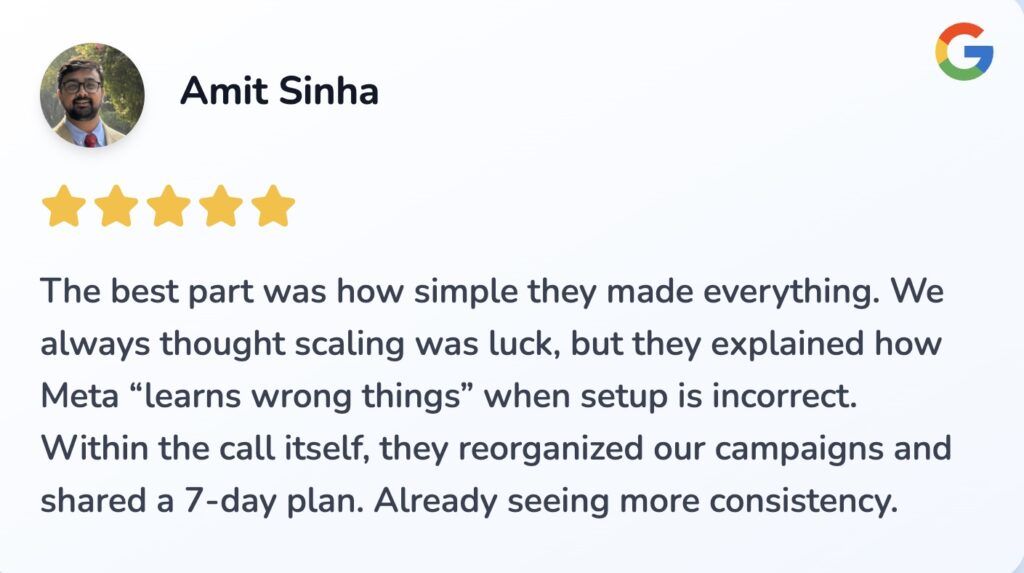

Success Stories

Rs. 1,999/- Rs. 99/- Only

Some Frequently Asked Questions

This masterclass is for parents of children aged 10–18 who want to guide their child’s money habits the right way.

Parents attend the masterclass.

You learn the structure and then apply it with your child at home.

No. This session is parent-only.

You’ll decide how and when to introduce the learnings to your child.

Not at all.

This is basic, practical money education — no investing, no jargon, no complexity.

You’ll get a live masterclass, a clear money framework, and ready-to-use tools you can apply immediately at home.

Yes.

Money habits are built with small amounts first. That’s exactly why this stage matters most.

Yes.

Examples include UPI, online spending, subscriptions, and real Indian scenarios.